BRIAN MANG’OLI

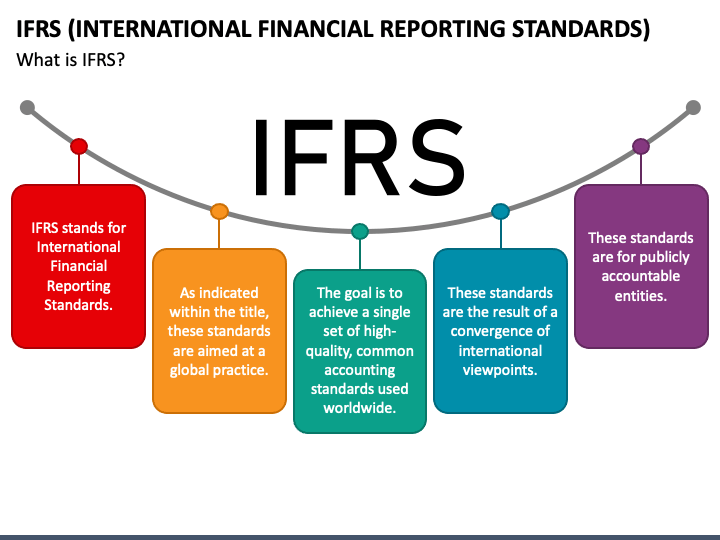

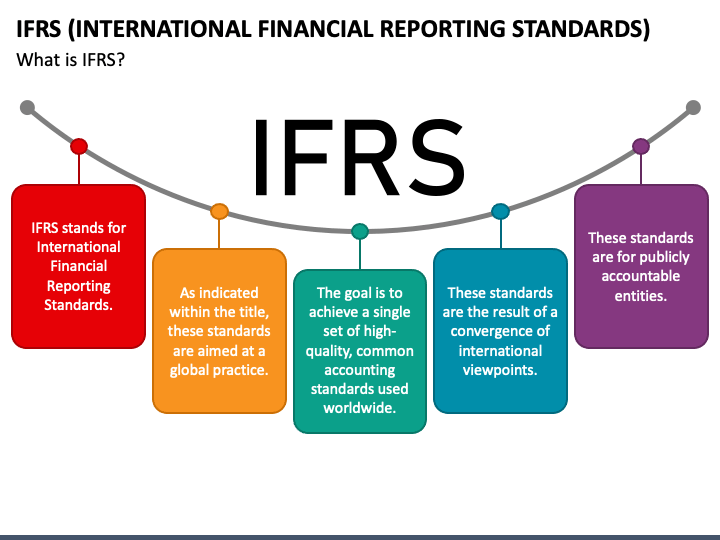

The implementation of the IFRS standards is expected to contribute to the promotion of consistency and comparability of sustainability-related disclosures across organizations. This will enhance the effectiveness of data analysis and benchmarking, enabling stakeholders to make informed decisions concerning investment opportunities and risk management strategies.

Kenya’s dynamic business landscape is currently facing a crucial moment in its financial sector as the country adopts new international financial reporting standards. The Institute of Certified Public Accountants of Kenya (ICPAK) has been organizing capacity-building events to assess the country’s potential in adopting the new standards developed by the International Sustainability Standards Board.

Sustainability is more than just a compliance requirement, it is a strategic necessity that promotes resilience, creativity, and value creation. IFRS 1 deals with disclosures on sustainability-related risks, while IFRS 2 requires firms to make disclosures on climate change.

The implementation of improved disclosure standards on climate-related risks and opportunities is crucial in boosting trust and confidence in a farm’s sustainability reporting.

Both reporting standards are critical for unlocking capital flows for farms, particularly in Africa, which is currently experiencing the detrimental effects of climate-related risks