| Felicitas Awino |

Kenyans are bracing for challenging times ahead as the government suggests new taxes on goods and services to generate extra revenue for the 2024/2025 budget.

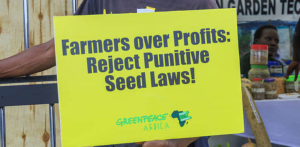

The new tax regulations will result in increased taxes and penalties for small business owners, bank customers and farmers.

Tea enthusiasts will also need to allocate more funds for their favorite beverage as the cost of tea packaging is expected to rise by 16%. A special parliamentary session has been scheduled for Monday to hasten the release of the Finance Bill, with assurances from relevant committees to take public feedback into account.

The Kenyan government is currently grappling with tough decisions as it looks to implement new taxes on various goods and services in order to secure additional funds for the upcoming 2024/2025 budget. This move is expected to have a significant impact on various sectors of the economy, with small business owners, bank customers and farmers all set to face higher taxes and penalties.

Tea lovers will also be affected by a 16% increase in the cost of tea packaging. To expedite the process, a special session of Parliament has been called for Monday to fast-track the publication of the Finance Bill, with a commitment from relevant committees to take public opinion into consideration before finalizing the proposals.

The Kenyan government is facing tough times ahead as it proposes new taxes on goods and services to raise additional funds for the 2024/2025 budget. If the new tax measures are approved, small business owners, bank customers, telco users, and farmers will have to pay more taxes and penalties.

Tea lovers will also feel the impact as the cost of tea packaging is set to increase by 16%. A special session of Parliament has been called for Monday to speed up the publication of the Finance Bill, with relevant committees promising to consider public opinion on the proposals.

Banking costs are also likely to have a ripple effect on farmers, especially those that rely on banking services for loans, savings, and other financial transactions. With the added burden of taxation on banks, these costs are likely to be passed on to customers in the form of higher fees and interest rates.

The increased cost of banking services could further strain the farmers’ financial stability. This could make it more difficult for them to invest in their farms, purchase necessary inputs, and access credit to expand their operations.

In addition, the increased competition within the East African Communities could also put pressure on farmers to lower their prices in order to remain competitive. This, combined with higher banking costs, could further squeeze their profit margins and make it harder for them to make a living.

The inclusion of banks in taxation is likely to have a significant impact on farmers within the East African Communities, making it more challenging for them to access the financial services they need to thrive and compete in the market.